Amanat Delivers Revenue Growth of 17% Driven by Strong Performance in Education

February 17, 2025

13 February 2025 | Dubai | Amanat Holdings PJSC (“Amanat” or the “Company”) (DFM symbol: AMANAT), the leading healthcare and education listed investment company, announces its financial results for the year ended 31 December 2024 (“FY 2024”).

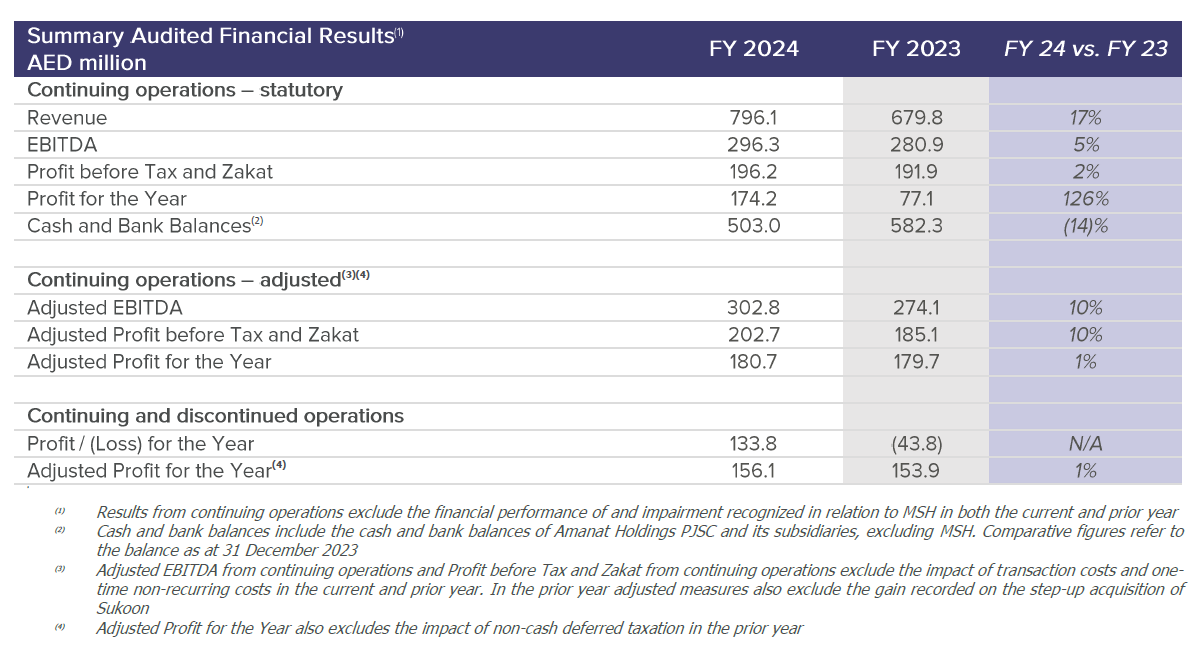

Revenue from continuing operations: Grew by 17% year-on-year to AED 796.1 million in FY 2024 driven by strong performance in Education and Healthcare, which grew 28% and 6% year-on-year, respectively

EBITDA from continuing operations: Increased by 5% year-on-year to AED 296.3 million in FY 2024, with a 22% increase in Education partially offset by a decline in Healthcare. On an adjusted basis, EBITDA increased by 10%

Profit before Tax and Zakat from continuing operations: Increased 2% year-on-year to AED 196.2 million in FY 2024, or 10% on an adjusted basis

Balance sheet: Significant cash balance of AED 503.0 million with low leverage at the end of FY 2024

Dividends: The Board recommends a final dividend of AED 40 million, amounting to 1.6 fils per share, subject to shareholder approval at the AGM. This brings the total dividend payout for FY 2024 to AED 115 million, amounting to 4.6 fils per share

FY 2024 Operating Highlights

• Masar Education Company: Creation of new company to hold ownership in Middlesex University Dubai (“MDX”), Human Development Company (“HDC”) and NEMA, with management team established and led by Majed Al-Mutairi as Chief Executive Officer.

• Record Education intake: The Education business saw record enrollments in 2024 with a total student and beneficiary base of circa. 23 thousand, up 18% year-on-year. MDX enrollments increased 16% year-on-year with NEMA up 14% whilst beneficiaries at HDC increased by 29%

• Delivering world class education: Abu Dhabi University, part of NEMA was ranked among the top 200 universities globally by Times Higher Education; MDX is rated 5* by the Knowledge and Human Development Authority (KHDA) and all HDC centers received the highest A+ rating from the Ministry of Human Resources and Social Development (MHRSD)

• Expanding special education needs network: HDC opened 8 new centers in 2024, following the launch of 6 new centers in 2023 taking total centers to 35. An additional 8 centers are under development and scheduled for opening in H2 2025

• KSA Long-Term Care growth: New facility in Khobar opened in November 2024, with 30 initial beds, growing in a phased manner to reach a total capacity of 150 beds. Jeddah capacity increase to 200 beds is in progress and expected to be completed in H2 2025.

FY 2024 Financial Highlights

• Revenue from continuing operations: Grew by 17% year-on-year to AED 796.1 million in FY 2024 driven by robust performance in Education

o Education: 28% year-on-year increase to AED 432.3 million, driven by record enrollments at MDX and HDC

o Healthcare / Long-Term Care (LTC): Revenue growth of 6% year-on-year to AED 363.8 million in FY 2024, supported by growth in KSA and the UAE PPP project, which more than offset near-term pressure on UAE revenues following the cessation of COVID related programs in July 2023. Robust growth is anticipated over future periods from capacity expansions and ramp-up of KSA operations, which will be supplemented by UAE patient growth

• EBITDA from continuing operations: Increased 5% year-on-year to AED 296.3 million in FY 2024 or 10% on an adjusted basis

o Education: EBITDA growth of 22% year-on-year to AED 245.0 million due to strong topline growth which was partially impacted by pre-opening costs associated with HDC’s new centers

o Healthcare (LTC): EBITDA declined 12% year-on-year to AED 90.7 million, impacted by the cessation of the COVID program in the UAE and pre-opening costs for the new Long-Term Care facility in Khobar

• Profit Before Tax and Zakat from continuing operations: Increased by 2% to AED 196.2 million in FY 2024 or 10% on an adjusted basis

• Profit for the Year: Increased to AED 133.8 million in FY 2024 compared to a loss of AED 43.8 million in FY 2023, impacted in the prior year by the one-time non-cash deferred taxation adjustment following the introduction of UAE corporation tax and a non-cash impairment recorded in respect of Malaki Specialist Hospital (MSH). In the current year MSH has been classified as an asset-held-for-sale with a further AED 15.8 million impairment recorded. Excluding these items, Profit for the Year was 1% higher when compared to the prior year or 11% higher when adjusted for the impact of UAE corporation tax in the current year.

Amanat’s Chairman, Dr. Shamsheer Vayalil, said:

“Amanat maintained strong momentum in 2024 with the execution of its growth strategy. Education performed strongly, as we achieved record enrolments and expanded our network of Special Education Needs centers. In Healthcare, we continue to focus on expanding bed capacity in Saudi Arabia to address the critical need for Long-Term Care. Our market-leading assets and strong brand reputation position us to continue to capture the growing demand for high-quality specialized education and healthcare in the region.

“Our performance and commitment to returning value to shareholders enables us to pay an attractive dividend with a final dividend, subject to shareholder approval, of AED 40 million for 2024, bringing our total payout for the year to AED 115 million. Additionally, we continue to progress our plans for an IPO of our education business, further demonstrating our focus on realizing value.”

Commenting on the results, John Ireland, Chief Executive Officer, added:

“Amanat delivered strong results in FY 2024, as we focused on topline revenue growth. Revenue for the year increased 17% driving adjusted EBITDA growth of 10%. Education saw record enrolments, with the momentum continuing into 2025, driven by the success of our international student recruitment strategy at MDX and the expansion of HDC’s daycare center network.

“Looking ahead, we continue to focus on driving growth with additional daycare centers under development in HDC, accelerated enrollment growth at MDX and the expansion of our LTC offering in Khobar and Jeddah.”