Amanat Reports 13% Revenue Growth in H1-2025 with Strong Momentum cross Healthcare and Education

August 13, 2025

13 August 2025 | Dubai | Amanat Holdings PJSC (“Amanat” or the “Company”) (DFM symbol: AMANAT), the leading healthcare and education listed investment company, announces its financial results for the six-month period ended 30 June 2025 (“H1 2025”).

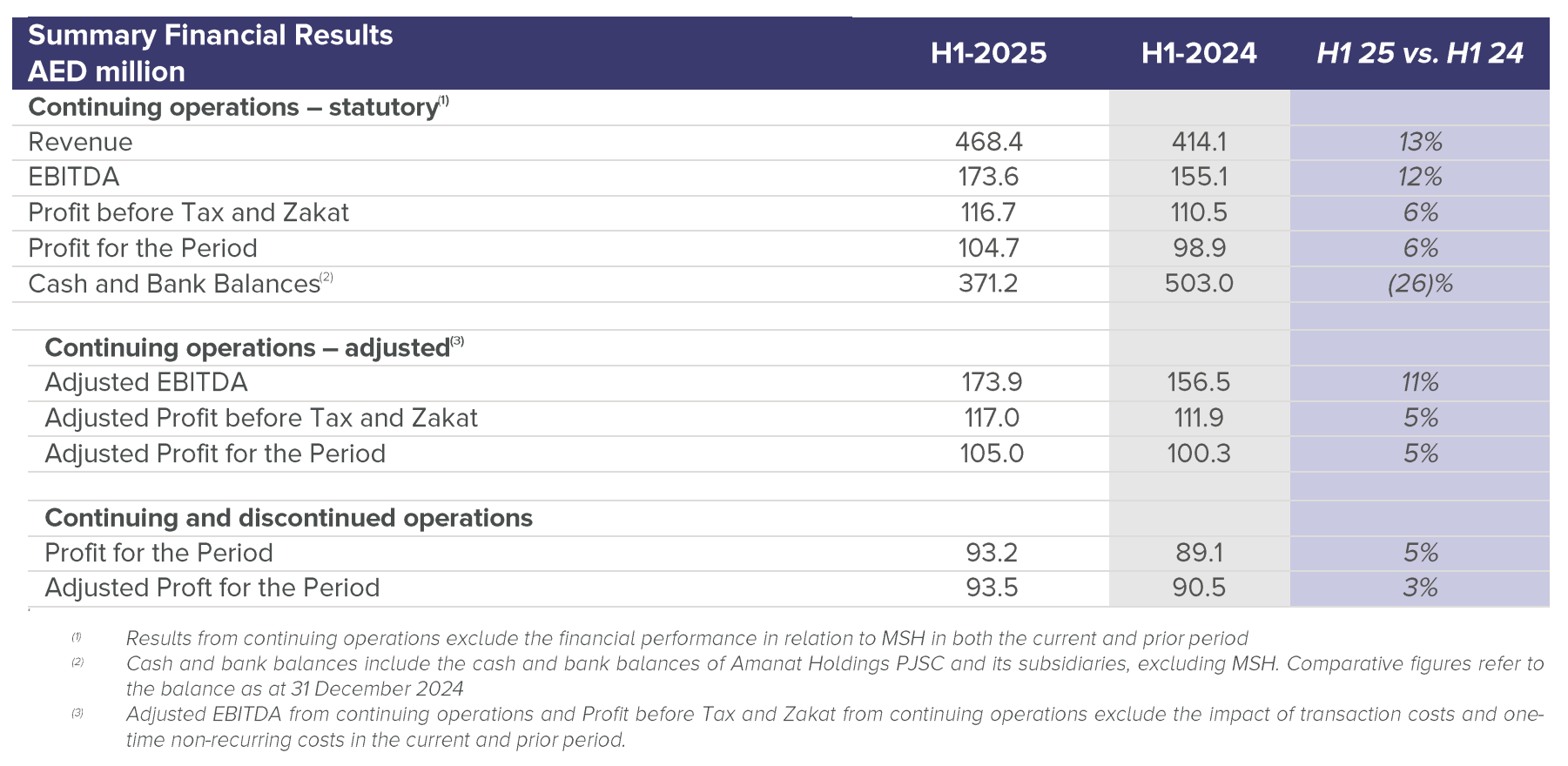

- Revenue from continuing operations: Increased 13% year-on-year to AED 468.4 million in H1 2025, driven by a strong performance at Education, where revenue increased 23% year-on-year

- EBITDA from continuing operations: Increased 12% year-on-year to AED 173.6 million in H1 2025 and 15% excluding ramp-up losses from the new 150 bed Khobar hospital. Education increased 15% year-on-year, with healthcare increasing 10% year-on-year, excluding ramp-up losses

- Profit from continuing operations: Increased 6% year-on-year to AED 104.7 million in H1 2025 and 13% excluding Khobar ramp-up losses

- Growth: Continued growth in education enrollments and beneficiaries reaching 23.9 thousand, 17% growth year-on-year. Continued growth in bed capacity with an additional 40 beds licensed in KSA post-period implying significant ramp-up potential

- Monetisation: Post-period, on 08 August, 2025 the Company entered into a Sale and Purchase Agreement (“SPA”) to divest the real estate assets of North London Collegiate School (“NLCS”) for AED 453 million

H1 2025 Operating Highlights

- Record student and beneficiary enrollments: Total students and beneficiaries increased by 17% year-on-year to a record 23.9 thousand. Middlesex University Dubai (“MDX”) grew 18% year-on-year to 6.2 thousand students, whilst NEMA grew 13% year-on-year to 11.3 thousand. In Special Education Needs (“SEN”), HDC beneficiaries increased by 25% year-on-year to 6.4 thousand.

- Post-acute care expansion: Progress on the Jeddah facility refurbishment and expansion continued in H1 2025, with bed capacity reaching 675 beds. Post-period, bed capacity further increased with the licensing of an additional 30 beds in Jeddah and ten beds in Dhahran, with Amanat continuing to review further expansion opportunities.

- New academic initiatives: MDX launched The London Sports Institute during the period, which offers cutting-edge education, professional training, and applied research in sport science. Post period, NEMA Holding acquired Biz Group a leading regional provider of corporate training, digital learning and team building.

- Portfolio activity: Malaki Specialist Hospital fully ceased operations, with excess cash used to repay external debt and divestment options being evaluated.

H1 2025 Financial Highlights

- Revenue from continuing operations: Grew by 13% year-on-year to AED 468.4 million in H1 2025, supported by a strong performance at Education and continued expansion at Healthcare.

- Education: Increased by 23% year-on-year to AED 284.9 million, driven by higher student and beneficiary enrollments across MDX and HDC.

- Healthcare: Grew by 1% year-on-year to AED 183.4 million in H1 2025, with growth in Dhahran and Khobar offset by the impact of discontinued COVID-related programs in the UAE.

- EBITDA from continuing operations: Reached AED 173.6 million, up 12% year-on-year, with strong growth at Education partially offset by a 1% year-on-year decline at Healthcare, which when adjusted for Khobar ramp up losses, increased by 15% year-on-year.

- Education: EBITDA rose by 15% year-on-year to AED 151.4 million in H1 2025, reflecting continued revenue growth, partially offset by costs associated with the recent Almasar head office and ramp-up costs from the new SEN daycare centers.

- Healthcare: EBITDA declined by 1% year-on-year to AED 39.6 million in H1 2025, impacted by ramp-up costs at Khobar. Excluding Khobar, EBITDA increased 10% year-on-year.

- Profit from continuing operations: Increased by 6% year-on-year to AED 104.7 million in H1 2025. Excluding Khobar, net profit from continuing operations increased by 13% year-on-year.

Amanat’s Chairman, Dr. Shamsheer Vayalil, said:

“Amanat delivered further strong performance in the first half of 2025 with double-digit revenue and EBITDA growth, driven by record enrollments and beneficiaries at Education, and capacity expansion and growth initiatives at Healthcare. The strong momentum in both Healthcare and Education ensures Amanat is well positioned to deliver future growth and we remain focused on building market-leading businesses that deliver long-term value and that have a positive contribution to society.

“In August, we announced the agreement to divest our education real estate asset for AED 453 million, clearly demonstrating our ability to unlock value across the portfolio and our continued commitment to deliver value to shareholders.”

Commenting on the results, John Ireland, Chief Executive Officer, added:

“Our first-half results reflect ongoing positive momentum across our market-leading businesses, with revenue and EBITDA increasing 13% and 12% year-on-year, respectively. Our Education business remained a key driver, underpinned by record enrollments and enhanced academic offerings, with eight daycare centers launched last year and further under development. In Healthcare, we delivered further operational progress, including capacity expansions at Jeddah and Dhahran, whilst we continue to ramp up activity at Khobar. Looking ahead, we remain focused on driving organic growth and executing our monetization strategy and continuing to build long-term shareholder value.”