Amanat Reports 15% Revenue Growth in 9M 2025 and Successful Execution of Monetization Strategy

November 12, 2025

Amanat Reports 15% Revenue Growth in 9M 2025 and Successful Execution of Monetization Strategy

12 November 2025 | Dubai | Amanat Holdings PJSC (“Amanat” or the “Company”) (DFM symbol: AMANAT), the leading healthcare and education listed investment company, announces its financial results for the nine-month period ended 30 September 2025 (“9M 2025”).

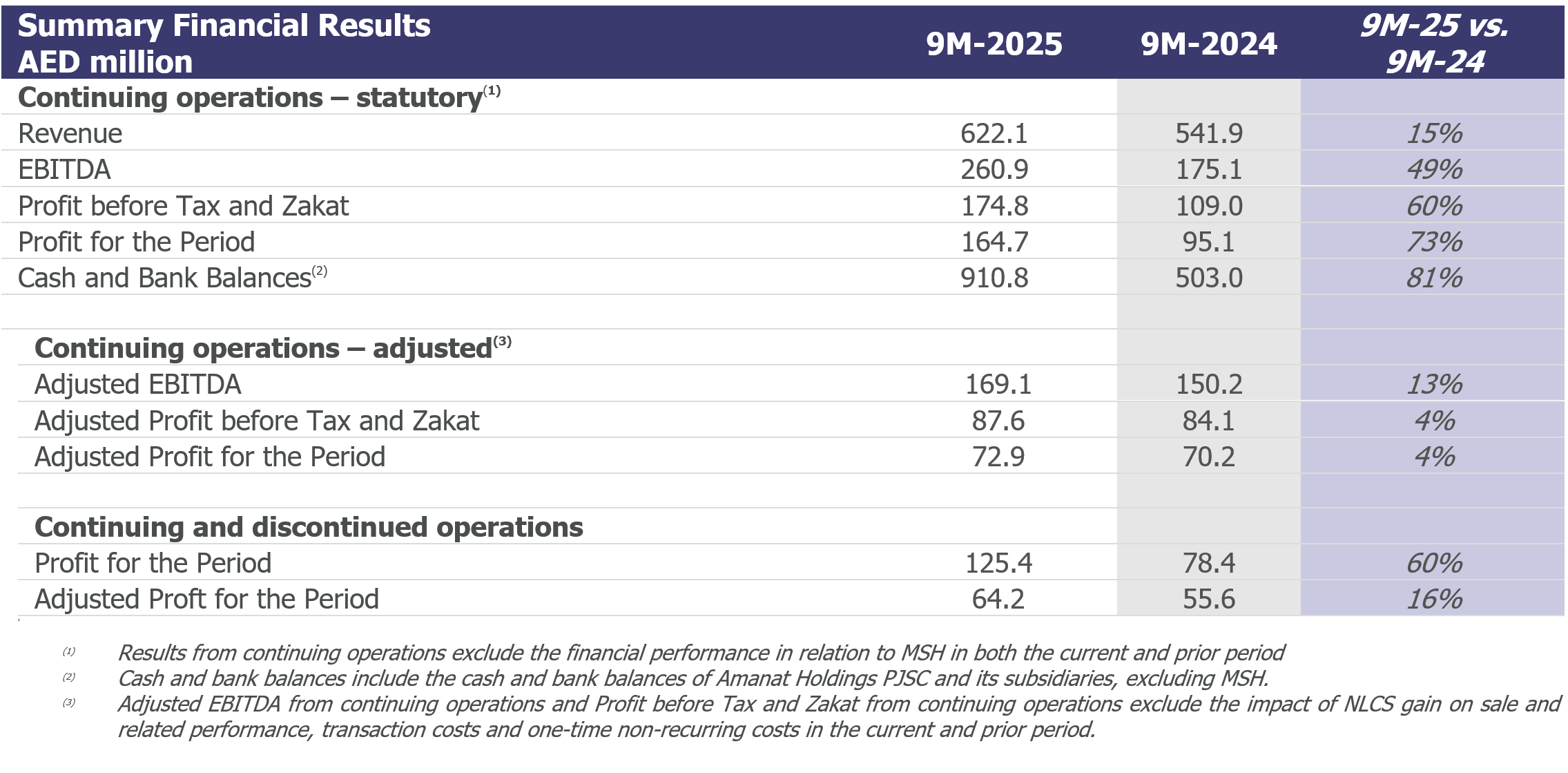

- Revenue from continuing operations: Increased 15% year-on-year to AED 622.1 million in 9M 2025, driven by a strong performance at Education, where revenue increased 24% year-on-year, and Healthcare where revenue increased 6% year-on-year

- EBITDA from continuing operations: Up 49% year-on-year to AED 260.9 million in 9M 2025 mainly due to successful divestment of the NLCS real estate; a 13% like-for-like increase excluding ramp-up losses from the new Khobar hospital and gain on disposal of NLCS

- Profit from continuing operations: Increased 73% year-on-year to AED 164.7 million in 9M 2025 and 14% on a like-for-like basis

- Operational momentum: Student and beneficiary numbers up 22% year-on-year to 28.0 thousand and bed capacity rising to 715. Q3 2025 Healthcare EBITDA up 37% year-on-year, excluding ramp-up-losses, demonstrating the successful execution of the Group’s Healthcare strategy

- Strategy execution and monetization: Successful divestment of the real estate assets of NLCS in August 2025, realizing cash proceeds of AED 453 million, a 1.7x cash-on-cash return, and generating a gain on disposal of AED 66.3 million

- Progress on Education IPO: Post-period, on 26 October 2025, Amanat’s Education business, Almasar Alshamil Education, announced its intention to float 30% of its share capital on the Saudi Exchange. On 12 November 2025, it announced the successful conclusion of the institutional book-building, with an oversubscription rate of 102.9 times and an order book of over SAR 61 billion, implying a market capitalization at listing of SAR 1,997 million and a total offering size of around SAR 599 million

- Cash position: AED 568.0 million in cash held centrally at period-end, with further proceeds expected from the Education IPO. The Board of Directors will, in due course, evaluate and recommend to the shareholders a capital allocation plan for the real estate and IPO proceeds, balancing shareholder returns with reinvestment into transformational opportunities

9M 2025 Operating Highlights

- Education growth: Students and beneficiaries rose 22% year-on-year to 28.0 thousand. MDX grew 12% to 6.4 thousand students; NEMA increased 25% to 13.6 thousand; and HDC beneficiaries grew 25% to 8.0 thousand. Post-period, in October 2025, Almasar signed a non-binding agreement with Heriot-Watt University to establish Heriot-Watt University Saudi Arabia

- Healthcare execution delivering results: Total capacity reached 715 beds in 9M 2025 from 660 in December 2024, supported by bed expansions in Jeddah and Dhahran. Q3 2025 revenue and EBITDA growth of 17% and 37% respectively, excluding Khobar ramp-up-losses, with utilization at 76%

- CMRC rebrand to Cambridge Health Group: Post-period, in October 2025, CMRC announced its rebranding to Cambridge Health Group, unifying Amanat’s post-acute care businesses under a single identity as part of efforts to scale operations and enhance regional visibility

- Malaki Specialist Hospital fully ceased operations, with impairment losses of AED 26.8 million booked to reflect fair value. The closure supports Amanat’s focus on optimizing its portfolio and enhancing returns

9M 2025 Financial Highlights

- Revenue from continuing operations: Grew by 15% year-on-year to AED 622.1 million in 9M 2025, supported by a strong performance at Education and continued expansion at Healthcare

- Education: Increased by 24% year-on-year to AED 332.3 million in 9M 2025, driven by enrollment growth across MDX and HDC.

- Healthcare: Up 6% year-on-year to AED 289.8 million in 9M 2025, reflecting execution of Amanat’s long-term Healthcare strategy, with capacity expansions at Dharan, Khobar and Jeddah driving growth

- EBITDA from continuing operations: Reached AED 260.9 million, up 49% year-on-year with double-digit growth across both businesses

- Education: Rose by 57% year-on-year to AED 216.3 million in 9M 2025, including the impact of the gain on disposal of NLCS. On a like-for-like basis EBITDA rose by 8%, noting that underlying growth was partly offset by costs associated with recently established Almasar head office

- Healthcare: Increased by 11% year-on-year to AED 68.8 million in 9M 2025, driven by newly expanded facilities contributing to profitability

- Profit from continuing operations: Increased by 73% year-on-year to AED 164.7 million in 9M 2025. Excluding Khobar ramp-up losses and the gain on disposal of NLCS, net profit from continuing operations increased by 14% year-on-year

Amanat’s Chairman, Dr. Shamsheer Vayalil, said:

“This quarter marks a significant milestone in Amanat’s journey as we continue to deliver on our strategy of investing in market-leading businesses, driving growth through disciplined execution and realizing value through attractive monetization opportunities. Our successful exit from NLCS generated strong returns for our shareholders, while the exceptional interest in the Almasar Education IPO post-period end, which saw an oversubscription rate of 102.9 times and valued the Education business at SAR 2.0 billion, underscores our ongoing value creation and strength of our portfolio.”

“With substantial cash available the Board will carefully assess the optimal balance between returning value to shareholders and reinvesting in transformational opportunities that will shape our next phase of growth”

Commenting on the results, John Ireland, Chief Executive Officer, added:

“Our results for the first nine months of 2025 highlight the continued delivery of Amanat’s strategy. Education maintained its momentum, supported by record enrollments whilst Healthcare performance strengthened during the period, with expanded capacity now translating into higher profitability. These results demonstrate that Amanat’s portfolio is well positioned for long-term growth and value creation.”

Investor Relations

Contact Details

Investor Relations Contact

James Anderson | Teneo

About Amanat Holdings PJSC

Amanat Holdings PJSC is the region’s leading listed operator of healthcare and education assets with paid-up capital of AED 2.5 billion. Listed on the Dubai Financial Market since 2014, Amanat’s mandate is to establish, acquire and integrate companies in the healthcare and education sectors; and develop, manage, and operate these companies within the MENA region and beyond.

Amanat’s Education business includes Almasar Alshamil Education, which holds MDX, the first overseas campus of the internationally renowned Middlesex University in London, HDC, the leading provider of special education and care services covering educational, medical, and rehabilitation services in KSA, and NEMA Holding, a leading provider of higher education in Abu Dhabi, UAE.

Amanat’s Healthcare business comprises of Cambridge Health Group, the GCC’s leading provider of post-acute, long-term, and rehabilitative care, operating six facilities across the GCC, including two in Abu Dhabi, and others in Al Ain, Jeddah, Khobar, and Dhahran.