Amanat Reports Revenue Growth of 13% in Q1 2025 with Education up 23% driven by Record Enrollments

May 13, 2025

Amanat Reports Revenue Growth of 13% in Q1 2025 with Education up 23% driven by Record Enrollments

13 May 2025 | Dubai | Amanat Holdings PJSC (“Amanat” or the “Company”) (DFM symbol: AMANAT), the leading healthcare and education listed investment company, announces its financial results for the three-month period ended 31 March 2025 (“Q1 2025”).

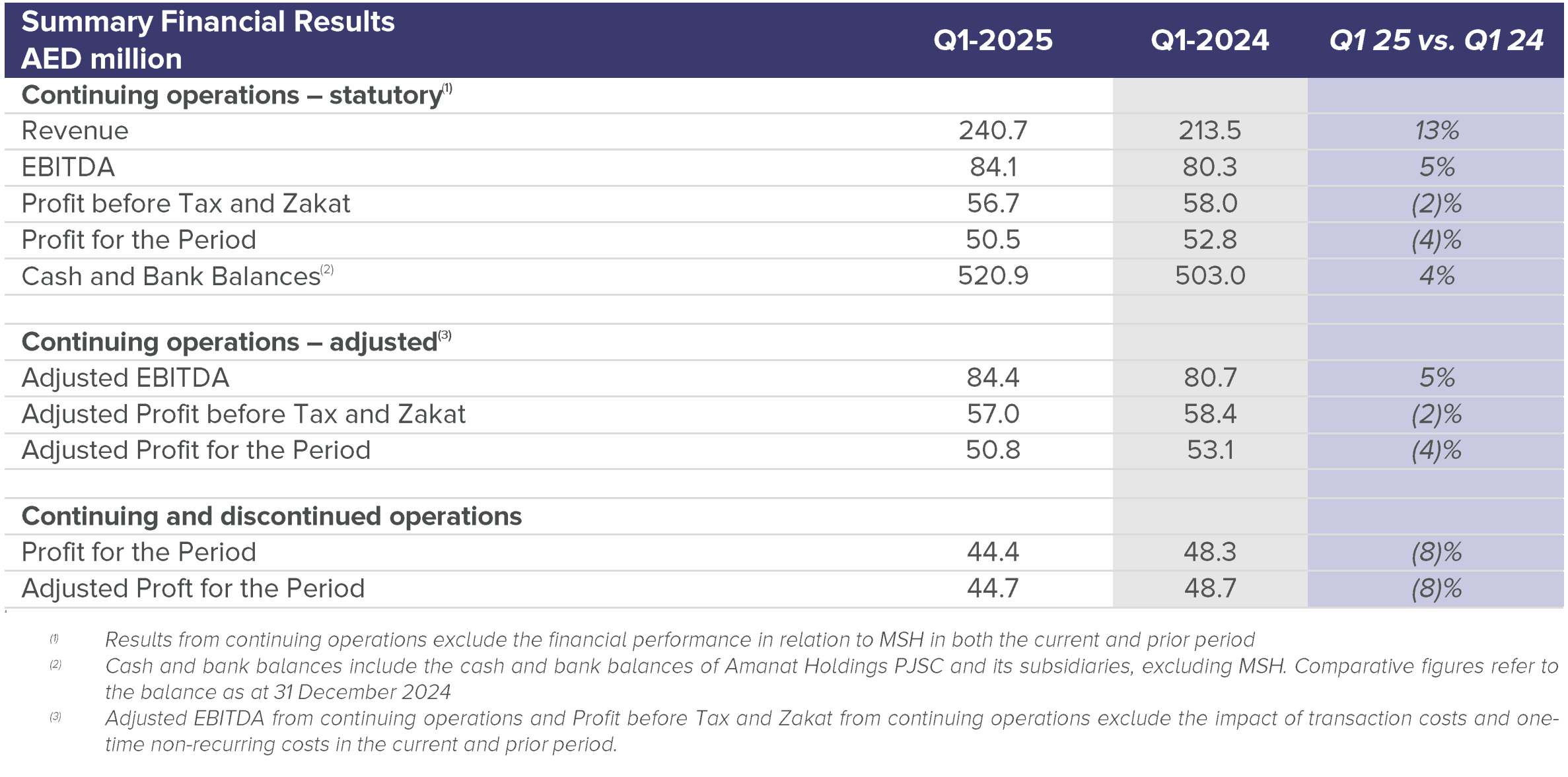

Revenue from continuing operations: Grew by 13% year-on-year to AED 240.7 million in Q1 2025 driven by strong performance at Education, which grew 23% year-on-year

EBITDA from continuing operations: Increased by 5% year-on-year to AED 84.1 million in Q1 2025, with a 12% increase at Education partially offset by the impact of ramp-up losses at Healthcare

Profit before tax and zakat from continuing operations: Declined by 2% year-on-year to AED 56.7 million in Q1 2025, impacted at Healthcare by pre-opening and ramp up costs from the Jeddah bed expansion and new Khobar facility, and at Education, by the newly established Almasar head-office established during the period to drive growth initiatives, and the recently launched and under-development SEN daycare centers

Balance sheet: Significant cash balance of AED 520.9 million with low leverage at the end of Q1 2025

Dividends: In April 2025, shareholders approved a final dividend of AED 40 million (1.6 fils per share) at the AGM bringing the total dividend payout for FY 2024 to AED 115 million (4.6 fils per share)

Post-period: Post-period the Company, as part of its continuous focus on returning value to shareholders, announced the exercise of its option to sell its education real estate asset, which will generate a return in excess of the carrying value of the asset

Q1 2025 Operating Highlights

• Strong student and beneficiary growth: 18% growth in students and beneficiaries to 23.7 thousand. At Higher Education, MDX grew 15% to 6.2 thousand and NEMA grew 14% to 11.1 thousand. At Special Education Needs, beneficiaries increased by 28% to 6.4 thousand with good progress across the eight centers launched in 2024 and one in 2025, with seven facilities under development.

• Post-Acute Care growth: Capacity increased to 170 beds in Jeddah, with a further 30 beds to be launched in H2 2025. The new Khobar facility opened in November 2024, with 30 initial beds, growing in a phased manner to reach a total capacity of 150 beds. Further expansion opportunities remain under review.

Q1 2025 Financial Highlights

• Revenue from continuing operations: Grew by 13% year-on-year to AED 240.7 million in Q1 2025 supported by strong performance at Education and steady progress at Healthcare:

o Education: 23% year-on-year increase to AED 152.1 million, driven by ongoing enrollment and beneficiary growth across MDX and HDC.

o Healthcare: Marginal decline of 2% year-on-year to AED 88.6 million, with revenue growth in Dharan and Khobar offset by a slight decline in the UAE from the impact of the discontinuation of COVID-related programs. A return to growth is anticipated in future periods due to capacity expansions and ramp-up in KSA operations and patient growth in the UAE.

• EBITDA from continuing operations: Increased by 5% year-on-year to AED 84.1 million in Q1 2025, with an increase at Education partially offset by a decline at Healthcare.

o Education: EBITDA grew by 12% year-on-year to AED 73.8 million, due to strong revenue growth, partially impacted by head office costs at the newly created Almasar head office and ramp-up / pre-opening costs from the launch of new SEN daycare centers.

o Healthcare: EBITDA declined by 10% year-on-year to AED 19.6 million, impacted by ramp up losses at the new Khobar facility and pre-opening costs associated with the bed expansion in Jeddah.

• Profit for the period from continuing operations: Marginally declined by 4% year-on-year to AED 50.5 million in Q1 2025, impacted by ramp up and pre-opening costs at Healthcare and the newly created Almasar head office and the impact of new / under construction daycare centers at Education.

Amanat’s Chairman, Dr. Shamsheer Vayalil, said:

“Amanat continued to deliver on its growth strategy in the first quarter of 2025 registering strong topline growth on the back of record enrollments and beneficiaries at Education, continuing the strong momentum seen in 2024. At Healthcare, the ramp-up of our long-term care facility in Khobar and the progress on expanding our Jeddah facility, positions us well for future growth and reflects our commitment to addressing the critical need for high-quality post-acute care across the region.

“Amanat remains focused on delivering value to shareholders, continuing with our monetization plan for Education and in May distributing a final dividend of AED 40 million bringing the total dividend paid for FY 2024 to AED 115 million. Additionally, post-period we announced the exercise of the option to sell our education real estate asset, generating an attractive return and in line with our strategic focus on exploring monetization opportunities for shareholders.”

Commenting on the results, John Ireland, Chief Executive Officer, added:

“Amanat reported strong topline growth in Q1 2025, with revenue increasing 13% year-on-year, supported by strong performance at Education and steady progress at Healthcare, driving EBITDA 5% higher year-on-year. Our Education business saw strong revenue growth of 23% year-on-year supported by the success of our international recruitment strategy at MDX and the expansion of HDC’s daycare center network, while at Healthcare we expect positive growth momentum in future periods as we ramp-up our Khobar and Jeddah facilities.

“Looking ahead, we continue to focus on driving growth with additional daycare centers under development in HDC, accelerated enrollment growth at MDX and the expansion of our Post-Acute Care offering in Khobar and Jeddah.”